According to the International Monetary Fund, the U.S. dollar is the most popular. As of the fourth quarter of 2019, it makes up over 60% of all known central bank foreign exchange reserves. That makes it the de facto global currency, even though it doesn’t hold an official title. The global currency is useful when creating enterprise-wide analyses. For example, a user might want to view enterprise-wide data in other currencies. For every monetary amount extracted from the source, the load mapping loads the document and local amounts into the target table.

What Australian notes are worth money?

- ZAF 45000* to ZAF 99999*. The ZAF 45116* certified PCGS GUNC-67 sold for around $3,000 at auction in 2019.

- ZAG 00001* to ZAG 99999*. The ZAG 05787* certified PMG GUNC-66 sold for around $2,750 at auction in 2018.

- ZAH 00000* to ZAH 17000*

The graphic symbol in the first column will always be visible, but the symbols in the other columns may or may not be available, depending on which fonts are installed on your computer. PIMCO’s Digital Asset Working Group offers an educational Q&A on issues related to cryptocurrency. «Most Active Currency for International Payments in 2021, Based on Transaction Value.»

These are countries where the euro has still not been adopted, but who will join once they have met the necessary conditions. Mostly, it consists of countries of member states which acceded to the Union in 2004, 2007 and 2013, after the euro was launched in 2002. Inasmuch as one reason for the border closure was currency conversion, it was not uncommon for border crossers to have their money confiscated. Another, no less important, consequence had been the outstanding role assumed by the pound sterling among the world’s reserve currencies.

Euro

During World War I, many countries had to abandon the gold standard. In the late 1920s, the “gold exchange standard” was introduced which allowed the exchange of a local currency for gold or for other currencies that were still backed by gold, such as the British pound and the U.S. dollar. However, the economic crisis that began in 1929 took its toll; in 1931, the U.K. Many global companies and investment management firms use the FX markets to hedge their currency exposures. Investors seeking profits through the FX markets can use different approaches to investing in currencies.

The Central bank devalued the currency to curb rising inflation. They benefited from having a stable currency over a long period of time. Больше примеров Take some foreign currency to cover incidentals like the taxi fare to your hotel.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own npbfx review risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Больше определений для currency

Although part of the Netherlands, the islands of Bonaire, Sint Eustatius, and Saba do not use the euro; they use the United States dollar. There are 180 currencies recognized as legal tender in United Nations member states, UN observer states, partially recognized or unrecognized states, and their dependencies. However, excluding the pegged currencies, there are only 130 currencies that are independent or pegged to a currency basket. Dependencies and unrecognized states are listed here only if another currency is used on their territory that is different from the one of the state that administers them or has jurisdiction over them. The euro has become the second most traded currency behind the U.S. dollar.

You could sustain a loss of some or all of your initial investment and should not invest money that you cannot afford to lose. Offering one of the higher interest rates in the major global markets, the Reserve Bank of Australia has always upheld price stability and economic strength as cornerstones of its long-term plan. Headed by the governor, the bank’s board is made up of six members-at-large, in addition to a deputy governor and the Secretary to the Treasury. Together, they work toward to target inflation between 2% and 3%, while meeting eleven times throughout the year.

The Japanese yen is easily the most traded of Asian currencies and viewed by many as a proxy for the underlying strength of Japan’s manufacturing and export-driven economy. Forex traders also watch the yen to gauge the overall health of the Pan-Pacific region as well, taking economies such as South Korea, Singapore, and Thailand into consideration, as those currencies are traded far less in the global forex markets. The official currency of the majority of the nations within the eurozone, the euro was introduced to the world markets on Jan. 1, 1999, with banknotes and coinage entering circulation three years later. In addition, due to the U.S. dollar’s global acceptance, it is used by some countries as an official currency, in lieu of a local currency, a practice known as dollarization.

Browse Forex

While specific proposals have been mentioned now and again in the media, the response has been barely discernible. It is evident that the choice between the 3 baskets is not an issue of much consequence. The first is that the geographical distribution of trade (excluding intra-trade) of the countries is similar.

What are the 3 major currencies?

- 1. U.S. Dollar (USD)

- European Euro (EUR)

- Japanese Yen (JPY).

- British Pound (GBP)

- Swiss Franc (CHF)

- Canadian Dollar (CAD)

- Australian/New Zealand Dollar.

- South African Rand (ZAR)

These can include the BoJ meeting announcement, GDP data, the index of industrial production, the Tankan survey, and unemployment numbers. The forex market is the biggest market in the world, accounting for an average of $6.6 trillion worth of trades each day. Here we take a look at the top 10 most traded currencies, which are involved in nearly 90% of trades. Similar to the euro, the Swiss franc hardly makes significant moves in any of the individual sessions.

The euro, Japanese yen, Australian dollar, Canadian dollar, and British pound are also actively traded currencies. An alternative approach would be for each of the East Asian countries to peg its currency to a common basket. Let us assume for the moment that the relevant group of countries does indeed consist of the 9 economies that have been discussed in this paper. The first point that has to be acknowledged is that East Asian countries have for some years managed their exchange rates far better than other groups of developing countries. They have not crucified their economies by misconceived attempts to use the exchange rate as a nominal anchor.

Comparing Risk Assets in Mid

Average daily ranges are in the region of 70 to 140 pips, with extremes well over 200 pips. The Japanese yen tends to trade under the identity of a carry trade component. The main monetary Policy Board tends to work toward economic stability, constantly exchanging views with the reigning administration, while simultaneously working toward its own independence and transparency. In a similar fashion to the FOMC, the ECB has a main body responsible for making monetary policy decisions, the Executive Board, which is composed of four members plus a president and vice-president. As with any currency, the dollar is supported by economic fundamentals, includinggross domestic product , and manufacturing and employment reports.

To use individual functions (e.g., mark statistics as favourites, set statistic alerts) please log in with your personal account. Discover the range of markets you can spread bet on – and learn how they work – with IG Academy’s online course. Stay on top of upcoming market-moving events with our customisable economic calendar. As a result, the currency can be seen as most volatile through both London and U.S. sessions, with minimal movements during Asian hours (8 p.m. to 4 a.m. EST). As such, the MPC also has a benchmark of consumer price inflation set at 2%.

Meeting about monetary policy 8 times a year, the governor leads a team of nine policy members, including two appointed deputy governors. As a result, policymakers will turn their focus to consumer inflation in making key interest rate decisions. Created in 1913 by the Federal Reserve Act, the Federal Reserve System—also called the Fed—is the central banking body of the U.S.

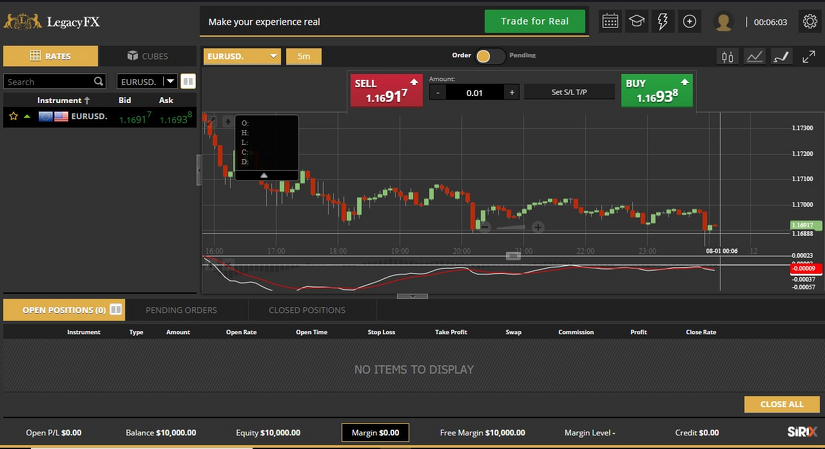

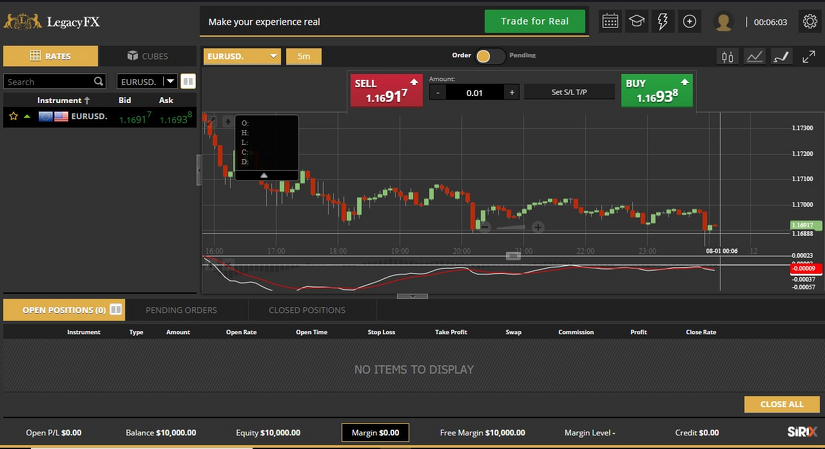

How much does trading cost?

If this benchmark is compromised, the governor has the responsibility to notify the Chancellor of Exchequer through a letter, one of which came in 2007 as the U.K.Consumer Price Index rose sharply to 3.1%. To trade this currency with a little bit of a bite, focus on the crossover of London and U.S. hours (8 a.m. to noon EST). The policy heads of the ECB are chosen with the consideration that four of the seats are reserved for four of the five largest economies in the system, which include Germany, France, Italy, Spain, and the Netherlands.

By that time, the dollar had already become the world’s dominant reserve currency. But, unpegging the dollar from its value in gold created stagflation. Currency symbols are a quick and easy way to show specific currency names in a written form.

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact. For example, if your organization is a multinational enterprise that has its headquarters in the United States, you probably want to choose US dollars as one of the three global currencies. Whether you’re travelling abroad and curious about the local currency or just were looking for how to add a currency symbol to your document – hopefully you’ve found it.

Biagio Bossone and Marco Cattaneo write that the introduction of a Greek parallel currency could take place in at least two ways. The first avenue would be for Greece to issue IOUs, i.e., promises to pay to the bearer euros upon a future time expiration. Basically, these IOUs would be euro denominated debt obligations issued and used to replace euros to pay salaries, pensions, etc.

Another reason is that the countries still have too wide a range of preferences as regards exchange rate policy, and of inflation rates, to permit adoption of as tight a system as the ERM, with its presumption against frequent parity changes. The Thai baht was officially pegged to the US dollar until a devaluation in November 1984, at which time it was announced that its value would be determined on the basis of a weighted basket of the currencies of Thailand’s major trading partners. The same formula has been repeated ever since in the IMF’s Annual Report on Exchange Arrangements and Exchange Restrictions. It is therefore somewhat surprising that, despite the gyrations in the value of the dollar, the baht has never varied more than about 5 percent from a rate of 26 bahts to the dollar.

However, in some European countries it is common to use the symbol at the end of the amount – so you might see 50€ written in France or Germany. To format currency in a React component, use the Shopify/react-i18n library’s formatCurrency method. You can select either short or explicit formatting by setting forex scalpers the form option as shown in the code example below. Mock up a scenario where the store, presentment, payout, and billing currencies are different. This scenario is becoming more common as more merchants start selling globally. This example shows the use of short format for installment prices.

Asia Market Outlook 2022: Diversified Opportunities Amid Volatility

In this example, we have defined the name and class of the field type, and defined the defaultCurrency as «USD», for U.S. We have also defined a currencyConfig to use a file called «currency.xml». lexatrade review This is a file of exchange rates between our default currency to other currencies. There is an alternate implementation that would allow regular downloading of currency data.